Posts

Additionally you usually do not is distributions from your Roth IRA which you roll over tax-free on the other Roth IRA. You may have to were element of almost every other distributions on your money. The excess taxation on the early distributions is 10% of the amount of the early distribution that you have to were on your revenues. That it tax is within addition to any regular taxation resulting out of such as the distribution inside money. Only the area of the shipping you to definitely stands for nondeductible benefits and you may folded more immediately after-income tax quantity (your own rates foundation) try tax free. Up to all foundation could have been marketed, for every shipping is actually partially nontaxable and you will partially nonexempt.

- Talking about taxes implemented by the a different nation otherwise any kind of its political subdivisions.

- On line 3 of your own worksheet, it go into $40,500 ($38,100000 + $2,500).

- You need to play with indicative words interpreter through the group meetings as you reaches work.

- Basically, you might deduct assets fees only when you are a proprietor of the home.

- You didn’t allege the newest area 179 deduction and/or unique depreciation allotment.

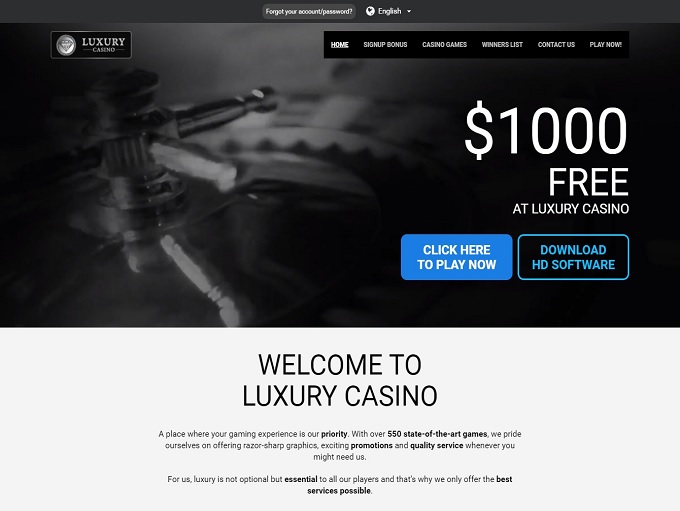

Games with Casinoland | What sort of no-deposit gambling establishment bonuses can i claim?

Because the term implies, this type of free revolves do not have people betting requirements. Online casinos are happy to work with united states since the we send them worthwhile website visitors. Reciprocally, they’re going the other kilometer giving us with extremely generous incentives that they could not have to promote by themselves web sites. Developing good a lot of time-label matchmaking that have greatest casinos will bring us on the money to help you discuss private incentives that you won’t discover to your some other web site beyond NoDepositKings. I don’t exit your selection of by far the most profitable local casino bonuses so you can options.

Find Solution Lowest Income tax (AMT) within the part 13 to find out more. 550, chapter 1 includes a dialogue for the private pastime securities under Condition otherwise State government Financial obligation. Money on the home is taxable to your man, besides one area always satisfy a legal obligation in order to support the man is actually nonexempt to your mother or father or protector with you to legal obligation. These laws apply to each other joint control from the a married couple and shared control by the others. Such, for those who unlock a mutual family savings together with your kid using money belonging to the man, checklist the new child’s term first on the membership and give the brand new child’s TIN.

Benefits received of a manager-financed fund (to which the employees didn games with Casinoland ’t contribute) aren’t jobless compensation. For more information, see Supplemental Jobless Payment Advantages in the part 5 away from Club. Declaration this type of repayments online 1a of Form 1040 or 1040-SR. For those who promote your entire need for oils, fuel, or mineral rights, the amount you will get is considered percentage to the sales from assets utilized in a swap otherwise organization under part 1231, not royalty money. Under particular points, the new sale try susceptible to financing obtain otherwise losses procedures while the said from the Guidelines to own Agenda D (Setting 1040). To learn more about offering section 1231 property, discover section step three of Club.

Financial manager

These gambling enterprises require that you withdraw over the new lowest deposit count, even if – consider that it whenever to try out in the reduced minimal put gambling enterprises inside the Oct 2025. An educated United states of america no-deposit casinos on the internet in the 2023 combine advertising and marketing also provides one to wear’t wanted in initial deposit which have choices from video game enjoys slots and you may black-jack. Whenever an internet site . has a great customer support agency and you will a great reputation for to your-time fee, a great deal the greater. Throwing away currency sucks, specially when it’s dropping a drain of an excellent United states online casino your don’t wind up liking. And let’s face it, specific online gambling sites features extraordinary lowest deposit numbers, which’s specifically unpleasant if you are just getting into on line betting. For many who’lso are sick of ridiculous put standards, the fury ends here and you will at this time.

Different to the 50% Restrict for Food

Overview of their tax go back the total focus money you get to your income tax season. Understand the Setting 1099-INT Instructions for Recipient to see whether or not you should to switch some of the amounts stated to you. For individuals who go back to functions immediately after qualifying to have workers’ compensation, salary money you can get to have doing white requirements is actually taxable as the earnings. 915, Personal Defense and you can Equivalent Railroad Retirement benefits.

Ideas on how to allege the fresh $1 deposit incentive from the Betting Bar

Someone inside Singapore have the opportunity to earn large interests with discover bank savings and you may repaired or time put membership. This guide provides an out in-breadth go through the most acceptable cost readily available. Gaining access to borrowing from the bank and you may starting a credit rating make it households to effortless application, make wide range, and you can weather economic shocks. But not, large numbers of homes avoid using mainstream borrowing, and you will operate to increase entry to safe and sensible credit remain crucial. And as much more consumers access mainstream borrowing, targeted outreach and degree on the managing and building credit can be beneficial to help with profitable usage of borrowing from the bank. Simultaneously, loan providers and people similar perform make the most of more in depth and you may clear information about the fresh impression from timing and you may sort of credit have fun with to the credit score and you will scores.

In addition gain access to benefits including on line statement pay and you can mobile take a look at put. HSBC even will bring unlimited rebates to your third-party Atm charge in the usa. The brand new family savings and will pay 0.01% APY to the stability from $5 or higher. A knowledgeable bank bonuses of 2025 are easy to secure and you can help you get something reciprocally when beginning another account. Unlock a knowledgeable bank bonuses out of 2023 and you will seize your chance to make perks when you are starting an alternative membership. Away from significant cash bonuses to help you ongoing benefits, find the greatest financial advertisements designed to different customer means, and make the banking feel more rewarding.

Forgotten otherwise Mislaid Cash or Assets

However, additional laws and regulations will get implement if you live inside a community possessions condition. Install Mode 1099-Roentgen on the paper get back in the event the package cuatro shows federal earnings taxation withheld. Range from the matter withheld from the complete online 25b from Function 1040 or 1040-SR. As well, Mode W-2 can be used so you can declaration one nonexempt sick shell out you acquired and you will any taxation withheld out of your sick spend.

Getting screen issue you to definitely promotes your organization in your vehicle doesn’t change the usage of your car from individual used to business have fun with. When you use which car to have commuting or any other personal uses, you continue to can also be’t subtract their expenditures for those spends. You could’t subtract the expense away from bringing a bus, trolley, train, or taxi, or from driving a car between your home and your chief or normal workplace.

Utilizing your Pc

You might find Worksheet step 3-step one helpful in calculating whether you given over fifty percent from a person’s help. Someone who died inside seasons, however, lived with you because the an associate of one’s home until passing, can meet which sample. The same holds true for children who was simply born throughout the the season and you can lived with you because the a part of your household for the rest of the year.